Little Known Questions About Pvm Accounting.

Pvm Accounting Can Be Fun For Everyone

Table of ContentsThe Single Strategy To Use For Pvm AccountingExamine This Report about Pvm AccountingSome Known Facts About Pvm Accounting.Pvm Accounting Fundamentals ExplainedThe Best Guide To Pvm AccountingAn Unbiased View of Pvm AccountingNot known Facts About Pvm AccountingAll about Pvm Accounting

Among the key factors for applying audit in building projects is the demand for financial control and management. Building and construction tasks usually need considerable investments in labor, materials, devices, and various other resources. Correct accounting permits stakeholders to keep an eye on and handle these funds successfully. Accountancy systems offer real-time insights right into project prices, profits, and success, enabling project supervisors to quickly determine possible problems and take restorative activities.

Bookkeeping systems allow firms to keep track of cash money flows in real-time, making sure enough funds are available to cover costs and satisfy economic obligations. Effective capital monitoring aids protect against liquidity dilemmas and maintains the job on course. https://www.quora.com/profile/Leonel-Centeno-4. Building and construction projects go through numerous financial requireds and reporting demands. Correct bookkeeping makes certain that all financial transactions are taped properly which the project follows audit standards and contractual contracts.

Pvm Accounting for Dummies

This minimizes waste and boosts task efficiency. To much better understand the significance of accounting in building and construction, it's likewise necessary to distinguish in between construction monitoring accounting and job administration accounting.

It focuses on the economic aspects of specific construction projects, such as expense evaluation, cost control, budgeting, and money flow administration for a particular project. Both sorts of bookkeeping are crucial, and they complement each other. Building and construction management bookkeeping makes certain the company's monetary health, while project management bookkeeping makes sure the economic success of individual jobs.

The Definitive Guide to Pvm Accounting

A critical thinker is needed, that will function with others to make decisions within their locations of duty and to surpass the locations' work procedures. The position will interact with state, university controller staff, university department personnel, and academic researchers. He or she is expected to be self-directed once the preliminary learning curve relapses.

Not known Details About Pvm Accounting

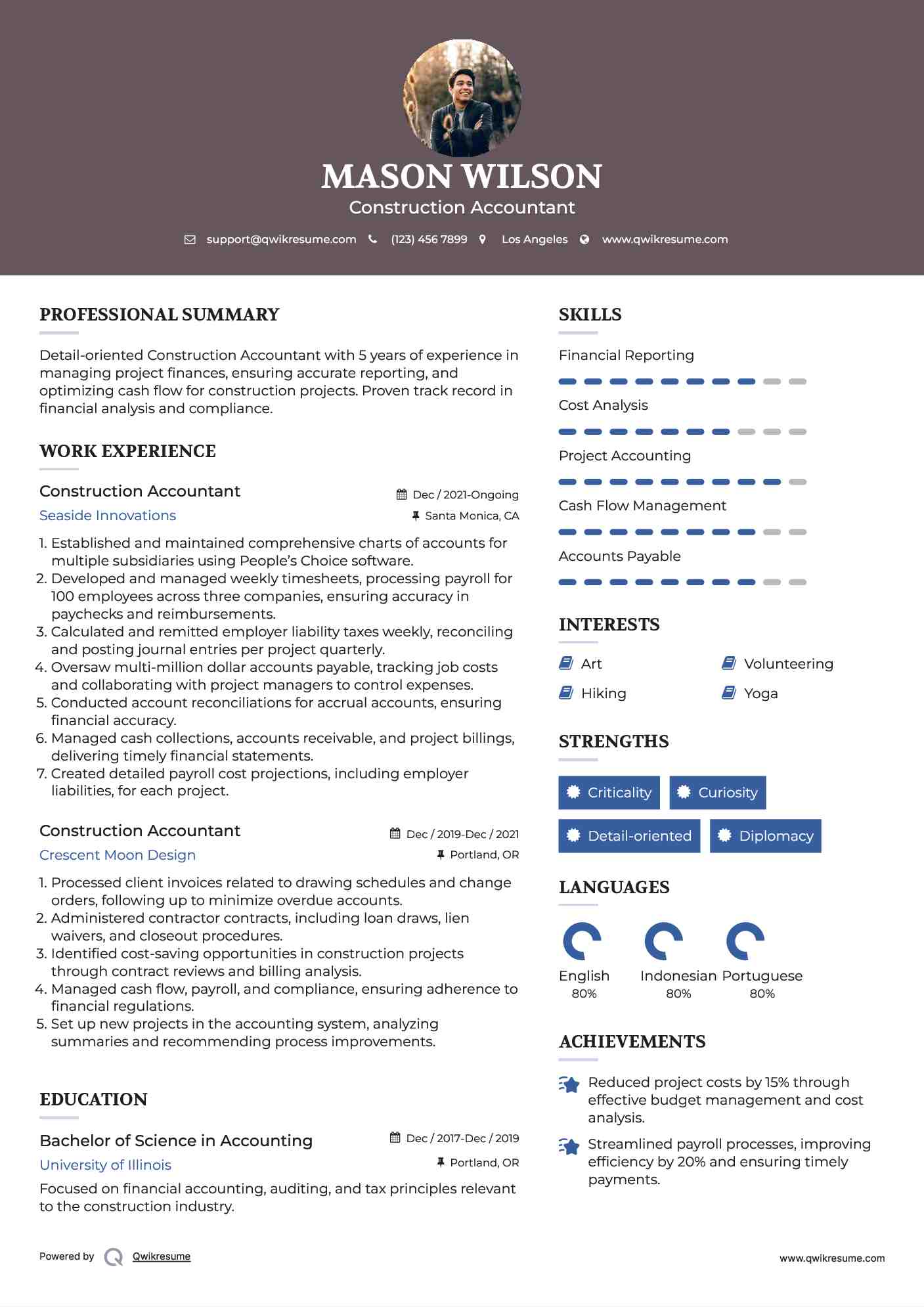

A Construction Accounting professional is in charge of taking care of the economic aspects of building and construction tasks, including budgeting, cost monitoring, economic reporting, and conformity with governing requirements. They function very closely with job supervisors, specialists, and stakeholders to ensure precise economic records, expense controls, and prompt payments. Their proficiency in building and construction accounting concepts, project costing, and financial evaluation is important for effective monetary monitoring within the construction market.

Things about Pvm Accounting

Payroll tax obligations are tax obligations on a staff member's gross wage. The profits from payroll tax obligations are made use of to fund public programs; as such, the funds gathered go directly to those programs rather of the Internal Income Service (IRS).

Note that there is an extra 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers making over $200,000. Profits from this tax obligation go towards federal and state joblessness funds to assist employees who have actually lost their work.

See This Report about Pvm Accounting

Your deposits have to be made either on a month-to-month or semi-weekly schedulean political election you make prior to each calendar year. Month-to-month settlements. A month-to-month settlement should be made by the 15th of the complying with month. Semi-weekly payments. Every other week deposit dates depend on your pay routine. If your cash advance drops on a check that Wednesday, Thursday or Friday, your deposit schedules Wednesday of the following week.

Take care of your obligationsand your employeesby making complete pay-roll tax obligation settlements on time. Collection and settlement aren't your only tax obligation duties.

The Best Guide To Pvm Accounting

Every state has its own unemployment tax obligation (called SUTA or UI). This is because your business's market, years in organization and unemployment history can all establish the percentage used to compute the amount due.

All About Pvm Accounting

The collection, compensation and coverage of state and local-level tax obligations depend on the federal governments that levy the tax obligations. Plainly, the topic of payroll taxes includes lots of moving components and covers a broad variety of bookkeeping understanding.

This website uses cookies to improve your experience while you navigate via the internet site. Out of these cookies, the cookies that are categorized as required are stored on your internet browser as they are essential for the working of standard capabilities of the website. We also use third-party cookies that help us analyze and understand how you use this internet site.